ykeudesign.ru

Overview

Does Southwest Have 1st Class

We do similar with other airlines and Business, or First Class - get on, stow stuff quickly and take our seats to free the aisles. Also, I do not mind if I. But, you need to know that SW does not have boarding classes, or reserved seats. There are, of course, more than 6 seats with extra legroom on a Southwest. No. Southwest Airlines does not have such thing as first-class seats. Being a low-cost carrier, its main aim is to offer affordable travel. Your chances of getting the exact seat that you want without paying for Business Select is slim to none. Being one of the first to board means that you'll get. Southwest-operated flights currently have open seating. Once onboard, simply choose any available seat and stow your carryon items in the overhead bin or under. The ad announced the launch of what Braniff called a “Get Acquainted” sale. It offered cut-rate $13 fares on its Dallas to Houston route. There is no First Class, Business Class, or Economy seats. As do to get your boarding pass which of course gets you on the plane. need for a world-class training experience. What does a First Officer's first year look like? Matched with a Southwest Airlines mentor. Your mentor is a. Southwest was first in the industry to offer ProfitSharing. · Southwest has an industry-leading balance sheet and investment-grade ratings from all three credit. We do similar with other airlines and Business, or First Class - get on, stow stuff quickly and take our seats to free the aisles. Also, I do not mind if I. But, you need to know that SW does not have boarding classes, or reserved seats. There are, of course, more than 6 seats with extra legroom on a Southwest. No. Southwest Airlines does not have such thing as first-class seats. Being a low-cost carrier, its main aim is to offer affordable travel. Your chances of getting the exact seat that you want without paying for Business Select is slim to none. Being one of the first to board means that you'll get. Southwest-operated flights currently have open seating. Once onboard, simply choose any available seat and stow your carryon items in the overhead bin or under. The ad announced the launch of what Braniff called a “Get Acquainted” sale. It offered cut-rate $13 fares on its Dallas to Houston route. There is no First Class, Business Class, or Economy seats. As do to get your boarding pass which of course gets you on the plane. need for a world-class training experience. What does a First Officer's first year look like? Matched with a Southwest Airlines mentor. Your mentor is a. Southwest was first in the industry to offer ProfitSharing. · Southwest has an industry-leading balance sheet and investment-grade ratings from all three credit.

Many airlines offer a range of amenities, such as first class, in-flight meals, and many drink options. Southwest Airlines, with its commitment to low-cost. Wondering if Southwest offers First Class? Scroll down and find everything about the Southwest Seat Selection to get your answers. It exclusively uses Boeing jets in its fleet. The airline has nearly 66, employees and operates about 4, departures a day during peak travel season. Southwest was first in the industry to offer ProfitSharing. · Southwest has an industry-leading balance sheet and investment-grade ratings from all three credit. Be one of the first to board with priority boarding. Pick the seat you want and have room for your carryon bags. Privacy Policy Trademarks Do Not Sell. Why don't bigger people just buy a business class or first class ticket? On Southwest, there are currently no business class or first class seats. On airlines. No. Southwest Airlines does not have such thing as first-class seats. Being a low-cost carrier, its main aim is to offer affordable travel. Our First Class train travel includes spacious leather seats, large tables, at-seat wireless charging and free Wi-Fi. Make your travel that extra bit. At Southwest ®, we offer four fares to get you more out of every flight: Business Select ®, Anytime, Wanna Get Away+ ®, and Wanna Get Away ®. What are Southwest First Class tickets? Southwest Airlines doesn't actually have a dedicated first-class fare, instead, it's known as Business Select. Everything you need to know before your first time flying with Southwest Airlines Flight credits unexpired on or created on or after July 28, do. need for a world-class training experience. What does a First Officer's first year look like? Matched with a Southwest Airlines mentor. Your mentor is a. Unlike many major airlines, Southwest does not use hubs, but rather a point-to-point system. About 15 airports with a significant amount of WN flights have been. There are four cabin classes offered on most airlines: economy, premium economy, business, and first class. “In the early days, all seats were first class,”. Our First Class train travel includes spacious leather seats, large tables, at-seat wireless charging and free Wi-Fi. Make your travel that extra bit. Flying first class to Los Angeles means enjoying benefits such as dedicated check in counters and priority boarding at the gate. First Class passengers also. There is no First Class, Business Class, or Economy seats. As do to get your boarding pass which of course gets you on the plane. Be one of the first to board with priority boarding. Pick the seat you want and have room for your carryon bags. Privacy Policy Trademarks Do Not Sell. Southwest Airlines first-class flights become cheap when you book with us. Try on-going 1st class Southwest Airlines deals and also explore business class. Unlike many major airlines, Southwest does not use hubs, but rather a point-to-point system. About 15 airports with a significant amount of WN flights have been.

Most Popular Currency

The world's most popular currency tools. Xe International Money Transfer. Send Create a chart for any currency pair in the world to see their currency history. The SDR is not a currency, but its value is based on a basket of five currencies—the US dollar, the euro, the Chinese renminbi, the Japanese yen, and the. What are the strongest currencies in the world? · 1. Kuwaiti dinar · 2. Bahrain dinar · 3. Omani rial · 4. Jordan dinar · 5. Pound sterling · 6. Gibraltar pound. It was first introduced in and has risen to become the most powerful currency globally. The USD is the most used currency in the world, both in reserve and. GBP, , , , *, JPY, , , , , *. Currencies Pairs. Most Viewed; US-Dollar; Euro; JPY; GBP. Name ▽, %. EUR/USD – or the 'fibre' – is widely considered the most popular forex pair as it typically comes with the highest volume and among the lowest spreads. Which currency is used the most in international trade? The U.S. dollar is the most widely used currency in international trade, even in trade between. What are the most traded currencies in the world? We break down each of the most popular currencies and find out the factors that cause their movement. Today, the dollar represents 58 percent of the value of foreign reserve holdings worldwide. The euro, the second-most-used currency, comprises only 20 percent. The world's most popular currency tools. Xe International Money Transfer. Send Create a chart for any currency pair in the world to see their currency history. The SDR is not a currency, but its value is based on a basket of five currencies—the US dollar, the euro, the Chinese renminbi, the Japanese yen, and the. What are the strongest currencies in the world? · 1. Kuwaiti dinar · 2. Bahrain dinar · 3. Omani rial · 4. Jordan dinar · 5. Pound sterling · 6. Gibraltar pound. It was first introduced in and has risen to become the most powerful currency globally. The USD is the most used currency in the world, both in reserve and. GBP, , , , *, JPY, , , , , *. Currencies Pairs. Most Viewed; US-Dollar; Euro; JPY; GBP. Name ▽, %. EUR/USD – or the 'fibre' – is widely considered the most popular forex pair as it typically comes with the highest volume and among the lowest spreads. Which currency is used the most in international trade? The U.S. dollar is the most widely used currency in international trade, even in trade between. What are the most traded currencies in the world? We break down each of the most popular currencies and find out the factors that cause their movement. Today, the dollar represents 58 percent of the value of foreign reserve holdings worldwide. The euro, the second-most-used currency, comprises only 20 percent.

The currency market is the largest and most liquid financial market in the world. Currencies like the U.S. dollar, the British pound, and the euro trade in. Here are the 7 major forex pairs that are considered to be the most popular across the world, all of which can be traded on using spread bets and CFDs. Currencies, Currency Markets, News and Rates on International Currency. Top 10 people most likely to reach trillionaire status · The $, electric. Top 10 currencies list · 1. Kuwaiti dinar (KWD) · 2. Bahraini dinar (BHD) · 3. Omani rial (OMR) · 4. Jordanian dinar (JOD) · 5. British pound (GBP) · 6. The U.S. dollar is the most commonly held, making up 59 percent of global foreign exchange reserves. Most Foreign Exchange Reserves Are in U.S. Dollars. Share. They do that by tracking the exchange rates of currencies that have the highest liquidity on the market. The U.S. Dollar index is the most popular and commonly. Chapter 5 · The most-traded currencies · #1 The American Dollar (USD) · #2 The Euro (EUR) · #3 The Japanese Yen (JPY) · Popular currency pairs · So, which. Such a high demand makes the US dollar the number one among currencies in the forex market, followed by the Euro, Japanese yen, and Pound sterling. These. Currencies News · Currency Converter · Key Cross Rates · Most Popular · More Currencies News · Advertisement · Advertisement · Search Results. The most common way is to measure a bilateral exchange rate. A bilateral exchange rate refers to the value of one currency relative to another. Bilateral. The Most Commonly Traded Currency Pairs in the Forex Market by Volume ; NZD/USD, GBP/CHF ; AUD/USD, GBP/JPY ; USD/JPY, CHF/JPY ; EUR/CAD, AUD/JPY ; EUR/AUD, AUD/NZD. Currencies like the Nigerian naira or the Tanzanian shilling are weaker because of their serious economic challenges. List of circulating currencies by state or territory. You can access popular currency crosses like GBP/USD, EUR/USD, and JPY/USD, or you can trade a central US dollar market against a basket of currencies. Futures. CURRENCIES · China's Forex Reserves Rose in August as U.S. Dollar Weakened · China's Foreign-Exchange Reserves Edged Down in June · Americans Are Everywhere—and. Here is a list comprising the top ten most traded currencies in the world: 1. US dollar (USD): The Federal Reserve (Fed) issues the US dollar which is the. Our comprehensive list of the most common currency pairs from across the globe provide live exchange rates and key information. The top currencies are the one most people would assume and align with some of the world's strongest economies, e.g., the US dollar, euro and Japanese yen. But. Most Popular · Investors renew focus on inflation data as Fed weighs size of expected September rate cut · The stock market is stumbling on nagging fears the Fed. What are the most traded currencies in the world? We break down each of the most popular currencies and find out the factors that cause their movement.

Small Stocks To Invest In Now

In recent years small cap premia diminished as large cap stocks have outperformed. Discover why small cap investing may be poised for a comeback You are now. Top Penny Stock Gainers ; BURU. Nuburu ; CURR. Currenc Group ; FLUX. Flux Power Holdings ; GRYP. Gryphon Digital Mining ; BKSY. BlackSky Technology. Small Cap StocksBSETrade Now ; Hindustan Unilever+. , · Personal & Household Prods. ; Life Insurance Corporation of India+. , · Insurance (Life). Historically, active managers have maintained an edge in small-cap investing. Why small-cap value now? We think now may be a good time to revisit small. Small-cap companies are said to be riskier investments because of their age, size, and the industries they serve. They are also more sensitive to market. Examples of mid cap stocks include Etsy, Twilio, and DocuSign. Small cap stocks. Small cap stocks are companies with a market capitalization between $ Check out the best small cap stocks to buy now in Benzinga updates our information daily to help you make the best investments. Small Cap StocksBSETrade Now ; Hindustan Unilever+. , · Personal & Household Prods. ; Life Insurance Corporation of India+. , · Insurance (Life). Underowned: Small-caps now represent just 4% of the broader U.S. stock market versus the long-term average of nearly 8%. This low percentage has occurred only. In recent years small cap premia diminished as large cap stocks have outperformed. Discover why small cap investing may be poised for a comeback You are now. Top Penny Stock Gainers ; BURU. Nuburu ; CURR. Currenc Group ; FLUX. Flux Power Holdings ; GRYP. Gryphon Digital Mining ; BKSY. BlackSky Technology. Small Cap StocksBSETrade Now ; Hindustan Unilever+. , · Personal & Household Prods. ; Life Insurance Corporation of India+. , · Insurance (Life). Historically, active managers have maintained an edge in small-cap investing. Why small-cap value now? We think now may be a good time to revisit small. Small-cap companies are said to be riskier investments because of their age, size, and the industries they serve. They are also more sensitive to market. Examples of mid cap stocks include Etsy, Twilio, and DocuSign. Small cap stocks. Small cap stocks are companies with a market capitalization between $ Check out the best small cap stocks to buy now in Benzinga updates our information daily to help you make the best investments. Small Cap StocksBSETrade Now ; Hindustan Unilever+. , · Personal & Household Prods. ; Life Insurance Corporation of India+. , · Insurance (Life). Underowned: Small-caps now represent just 4% of the broader U.S. stock market versus the long-term average of nearly 8%. This low percentage has occurred only.

Optimize your portfolio with JP Morgan's investment strategy insights. Stay informed with the market advice for smart investment planning. The best USA Small Cap ETF by 1-year fund return as of ; 1, Amundi S&P SmallCap ESG UCITS ETF Dist ; 2, SPDR MSCI USA Small Cap Value Weighted UCITS. Using the full history currently available from the Ken French data library (July – May ), we find small-cap value stocks have returned % annually. Every investor can easily add some small-cap stocks to his/her portfolio. However, as with any other type of investment, there are pros and cons of investing in. And because they are smaller, small-cap stock share prices have a greater chance of growth. Small-Cap Stock vs. Large-Cap Stock. As a rule, small-cap stock. Just started a small position with 30 shares, will continue to buy, like this stock a lot and have been looking for a renewable energy play. Best stocks under $10 to buy · SoFi Technologies (SOFI) · BGC (BGC) · ImmunityBio (IBRX) · Marqeta (MQ) · Geron (GERN) · Iovance Biotherapeutics (IOVA). The SCI highlights small-cap stocks often overlooked by Wall Street -- companies with excellent growth potential and high quality. Still, any asset-heavy business like this currently uses a lot of leverage. They have a long bond maturity profile and rather low interest rates on debt that is. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other experts follow these low-price stocks. Many penny stocks are. (partnerships, beating estimates, share buy back, acquisition) is also a serious possibility. Enterprise value is currently still around /. Small-Cap Stocks · BNY Mellon Global Fixed Income Fund Q2 Commentary · SPMO: A Mixed Bag For Momentum Seekers (But Still A Decent S&P Play) · Tsakos. Anytime you buy shares of a small, little-known company, there are a bevy of unknowns. Some small-cap stocks are clinical-stage biotechs whose drugs have yet to. Top Picks: 10 Best Small Cap Stocks. Our experts give you a detailed analysis of the 10 best small-cap stocks to buy now—before the market catches on. Small. List of Best Small Cap Shares to Invest ; img Laurus Labs Ltd. ₹ HOLD ; img Sun TV Network Ltd. ₹ HOLD ; img Aditya Birla Fashion & Retail Ltd. ₹. Small-cap stocks, those publicly traded companies with market invest in these smaller companies has been hard to find—until now. Author. Key Benefits of Small-Cap Investing: · Diversification - lower correlation to large-caps improves overall portfolio efficiency. · Growth potential - younger. Beware of Fake Portfolio Managers and Advisors: Protect Your Investments SMALL CAP FUND | TATA SMALL CAP FUND | UTI NIFTY FUND. MUTUAL FUNDS COMPANIES. Best small cap stocks for long term · 1. Carysil, , , , , , , , , , , · 2. Indo Thai Sec. investments after a financial downturn. Unfortunately, information about how to successfully invest in these smaller companies has been hard to find—until now.

How To Trade A Car With Money Still Owed

If the trade-in offer is less than your auto loan balance, you'll still owe money on the vehicle — this situation is known as negative equity. You can either. If so, it's definitely working in your favor to trade it in and use the leftover money for a down payment on the next vehicle. If not, you still have options. The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. Car dealers are very familiar with how to take trades with money owed on them, but often, when they try to explain the process the customer gets more confused. Rolling Over a Loan If you still owe money on your current ride, you could roll that negative equity onto the loan for your next car. You just want to make. You can sell a vehicle in many different ways. You can sell it to a private party, sell it to a dealer, or trade it in and try to get a credit toward a new car. Trading in a car with a loan you still owe on is possible, but is it right for you? Keep these tips in mind when trading in for a new vehicle. Yes, you're able to trade in a vehicle that you still owe money on. While the decision is ultimately up to you, our team is here to help explain your options. Trading in a car with a loan you still owe on is possible, but is it right for you? Keep these tips in mind when trading in for a new vehicle. If the trade-in offer is less than your auto loan balance, you'll still owe money on the vehicle — this situation is known as negative equity. You can either. If so, it's definitely working in your favor to trade it in and use the leftover money for a down payment on the next vehicle. If not, you still have options. The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. Car dealers are very familiar with how to take trades with money owed on them, but often, when they try to explain the process the customer gets more confused. Rolling Over a Loan If you still owe money on your current ride, you could roll that negative equity onto the loan for your next car. You just want to make. You can sell a vehicle in many different ways. You can sell it to a private party, sell it to a dealer, or trade it in and try to get a credit toward a new car. Trading in a car with a loan you still owe on is possible, but is it right for you? Keep these tips in mind when trading in for a new vehicle. Yes, you're able to trade in a vehicle that you still owe money on. While the decision is ultimately up to you, our team is here to help explain your options. Trading in a car with a loan you still owe on is possible, but is it right for you? Keep these tips in mind when trading in for a new vehicle.

A: If you still owe money on the car, you can trade it in for a cheaper one. If, for example, you owe $15, and the car is worth $20,, the dealer can. Sometimes the dealer will pay off the balance if you are buying a car that is more than your trade in is worth but that money will just be added. If the car is worth $15, and you still owe $20,, that is $5, of negative equity. Learn how to sell a car and get the most money for your vehicle. The two most common options people consider when it's time to sell a car that you still owe money on are trading it in at dealership towards your next car or. As noted above, if you still owe money on your vehicle after the trade-in, then you can either pay off the remaining balance or roll it over to your new loan. Yes, you can trade in a financed car, but you still have to pay off the remaining loan balance. However, this is not as intimidating as it sounds. If the remaining balance of your auto loan is more than the trade-in offer, this means that you'll still owe money on the vehicle-otherwise known as negative. You can do this with your funds after you complete the sale, or you can refinance your car loan or apply for a personal loan. Can you trade in a car financed. Yes, a dealership can & do buy cars that people still owe on. But need aware, any monies owed will be added into your new car amount & monthly. This means if the trade-in value of the vehicle is less than the loan amount you owe, you would owe the dealership money to cover the difference. At Credit. Instead, some dealers just roll over the negative equity into your new car loan, so you still end up paying it. Example. Say you want to trade in your car for a. If the vehicle is worth more than what you owe, you'll have positive equity. This means that the trade will at least cover all of what you own, so you can trade. Yes, you can still trade in a vehicle that you still have a remaining balance on. Ultimately, the decision is up to you and your financial goals. If the remaining balance of your auto loan is more than what you receive for your current car, you will still owe money on that loan. This is referred to as. One thing you should always do when you're considering trading in a car you haven't yet paid off is find out for sure exactly how much you still owe on the loan. If you owe more than the vehicle is worth, you'll have what's called negative equity, meaning the sale of your vehicle won't cover the amount you owe, so you'll. How to Trade in a Car You Owe Money On in 3 Steps · Determine how much you still owe on your current auto loan. · Calculate the trade-in value of your car with. Trading in a vehicle that you still owe money on means you will need to roll over the old loan into the new, combining the amount you're financing with the. Yes, it's absolutely possible to trade in your car even if you still owe money on the loan. However, you should keep in mind that you'll still have to pay off. You can trade in your car to a dealership even if you still owe money on it, but this can be a costly decision if you have negative equity.

278 Blood Sugar

+. 5' 11”. +. 6' 0”. +. 6' 1”. in which blood glucose levels are higher than normal). Talk to your doctor. units, subcut, inj, AC & nightly, PRN glucose levels - see parameters. Low Dose Insulin Regular Sliding Scale. If blood glucose is less than 70 mg/dL and. Hyperglycemia means that you have too much blood glucose. It happens when your blood glucose level is around mg/dL or higher. Hyperglycemia can happen if. Big Mac and my blood sugar. #insulinresistance #glucoselevels #bloodsugar #bigmac. K views · 1 year ago more. Insulin Resistant 1. K. A blood sugar level of mg/dL is elevated and may indicate poor blood sugar control, especially for individuals with diabetes. Diabet Med ;– OgawaW, Sakaguchi K. Euglycemic diabetic Diabetic ketoacidosis in pregnancy tends to occur at lower blood glucose levels. The A1C test gives you an average of your child's blood sugar control for the last 3 months. The A1C helps tell a person's risk of having complications from. When blood glucose, also called blood sugar, levels rise after you eat, your blood sugar. A1C (%) average blood sugar. +. 5' 11”. +. 6' 0”. +. 6' 1”. in which blood glucose levels are higher than normal). Talk to your doctor. units, subcut, inj, AC & nightly, PRN glucose levels - see parameters. Low Dose Insulin Regular Sliding Scale. If blood glucose is less than 70 mg/dL and. Hyperglycemia means that you have too much blood glucose. It happens when your blood glucose level is around mg/dL or higher. Hyperglycemia can happen if. Big Mac and my blood sugar. #insulinresistance #glucoselevels #bloodsugar #bigmac. K views · 1 year ago more. Insulin Resistant 1. K. A blood sugar level of mg/dL is elevated and may indicate poor blood sugar control, especially for individuals with diabetes. Diabet Med ;– OgawaW, Sakaguchi K. Euglycemic diabetic Diabetic ketoacidosis in pregnancy tends to occur at lower blood glucose levels. The A1C test gives you an average of your child's blood sugar control for the last 3 months. The A1C helps tell a person's risk of having complications from. When blood glucose, also called blood sugar, levels rise after you eat, your blood sugar. A1C (%) average blood sugar.

When blood glucose levels (also called blood sugar levels) are too high, it's called hyperglycemia. A major goal in controlling diabetes is to keep blood. Healthy volunteers in this study will be exposed to moderately low blood sugar levels and normal blood sugar levels. We look forward to hearing from. K views · 5 months ago #insulinresistance #diabetes #insulinsensitivity more. Mastering Diabetes. K. Subscribe. Share. Save. A blood sugar reading of mg/dL or more can be dangerous. If you have 2 readings in a row of or more, call your doctor. What causes high blood sugar? The reference range for a normal fasting glucose measurement is between 70 mg/dL ( mmol/L) and mg/dL ( mmol/L). Fasting blood sugar level, also known. Hyperglycemia means that you have too much blood glucose. It happens when your blood glucose level is around mg/dL or higher. Hyperglycemia can happen if. Schedule a worksite event today - call () Anchorage/Statewide Glucose), and Prostate Disease Screen (fasting 10 hrs.). $ Women's. pmol/L) It is synthesized in β cells of the pancreas and rapidly secreted into the blood in response to elevations in blood sugar levels (e.g., after a. Triglycerides are fats from the food we eat. Most of the fats we eat (like butter) are in triglyceride form. Extra calories, alcohol and sugar in your body turn. Blood Sugar Level Measurement by Glucometer. views · 6 months ago #bloodsugar #diabetes #Glucometer I Tried a Non-Invasive Blood Sugar. Table. Standard errors in mean blood glu- with the expected. The computation of the expected cose levels after challenge, by age and sex: United. 29 votes, comments. how bad would it be if your blood sugar was that high for a full day without ever coming down? units, subcut, inj, AC & nightly, PRN glucose levels - see parameters. Low Dose Insulin Regular Sliding Scale. If blood glucose is less than 70 mg/dL and. A higher than normal osmolality may be due to: Diabetes insipidus · High blood sugar level (hyperglycemia); High level of nitrogen waste products in the blood . The percentage of glycosylated hemoglobin in the blood reflects the average blood sugar levels over the preceding months. , PUBMED. Created. Blood Sugar() · Spring Valley Blood Sugar Support Dietary Supplement Vegetarian Capsules, 30 Count · ReliOn Platinum Blood Glucose Monitoring System · Metene. glucose reading of Doctor won't see him for Also I would switch doctors for not advising this in light of his blood sugar levels. Blood glucose monitoring is the use of a glucose meter for testing the concentration of glucose in the blood (glycemia). Particularly important in diabetes. Blood Sugar() · Spring Valley Blood Sugar Support Dietary Supplement Vegetarian Capsules, 30 Count · ReliOn Platinum Blood Glucose Monitoring System · Metene. units, subcut, inj, AC & nightly, PRN glucose levels - see parameters. Low Dose Insulin Regular Sliding Scale. If blood glucose is less than 70 mg/dL and.

How To Invest In The S&P 500

In the USA any broker can do that. An SP index fund or ETF like SPY will do that just fine. A broker might be able to automate that for you. “A low-cost index fund is the most sensible equity investment for the great majority of investors.” Warren Buffett. The rise of index investing. Index investing. Best index funds to invest in · Fidelity ZERO Large Cap Index · Vanguard S&P ETF · SPDR S&P ETF Trust · iShares Core S&P ETF · Schwab S&P Index Fund. How to start trading S&P (US) S&P trading is available on our xStation trading platform and you can start trading some of the American largest. The average year return of Nasdaq over these 15 years was around 9%, while that of S&P was about 5%. You could have earned a maximum year CAGR. Source: Morningstar®. The style box reveals a fund's investment style. The vertical axis shows the market capitalization of the stocks owned and the horizontal. What the S&P might mean for you. If you own individual large-cap stocks, you may likely be invested in one or more companies listed on the index. Many index. If you want to invest in the S&P , you first need a brokerage account. This can be a retirement account such as a traditional IRA or Roth IRA. I have a relatively newbie question. Should I go for dollar-cost averaging or try to time the market? Especially now, since the S&P is at its highest ever. In the USA any broker can do that. An SP index fund or ETF like SPY will do that just fine. A broker might be able to automate that for you. “A low-cost index fund is the most sensible equity investment for the great majority of investors.” Warren Buffett. The rise of index investing. Index investing. Best index funds to invest in · Fidelity ZERO Large Cap Index · Vanguard S&P ETF · SPDR S&P ETF Trust · iShares Core S&P ETF · Schwab S&P Index Fund. How to start trading S&P (US) S&P trading is available on our xStation trading platform and you can start trading some of the American largest. The average year return of Nasdaq over these 15 years was around 9%, while that of S&P was about 5%. You could have earned a maximum year CAGR. Source: Morningstar®. The style box reveals a fund's investment style. The vertical axis shows the market capitalization of the stocks owned and the horizontal. What the S&P might mean for you. If you own individual large-cap stocks, you may likely be invested in one or more companies listed on the index. Many index. If you want to invest in the S&P , you first need a brokerage account. This can be a retirement account such as a traditional IRA or Roth IRA. I have a relatively newbie question. Should I go for dollar-cost averaging or try to time the market? Especially now, since the S&P is at its highest ever.

You can harness the power of the S&P by trading or investing in ETFs and individual shares or trading on the index's value. S&P ; S&P Dow Jones Indices · NYSE · Nasdaq · Cboe BZX Exchange · ^GSPC; $SPX; ykeudesign.ru · · Large-cap. Investment Guide. S&P ETF. Top S&P ETFs. The S&P ® index. The S&P ® is the major US stock market index. It tracks the largest US companies. The chart below shows two hypothetical investments in the S&P over the year period ending December 31, Each investor contributed $10, every. You can invest in the S&P in your ROTH IRA (e.g. FXAIX). Anything you put into retirement accounts have the benefit of compound interest over. The S&P is widely used to (i) direct capital through “passive” investing, (ii) benchmark investment portfolios, and (iii) evaluate firm performance. The SPDR® S&P ® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P. The S&P is arguably the best known and most important stock market index in the world. It tracks the shares of of the largest companies in the United. To avoid common mistakes when investing in the S&P , investors should adopt a long-term perspective, avoiding market timing and emotional reactions to. Our S&P Plan provides investors access to leading stocks representing the most widely held companies from all sectors of the economy. There are a couple of ways to invest in the S&P High-net-worth investors can construct their own personal index. The S&P is an index that tracks the performance of the largest companies in the United States. For this reason, we use it as a proxy of the performance. The S&P Index measures the stock performance of large companies listed on US stock exchanges. It is not a fund that investors can put their money in. A straightforward, low-cost fund with no investment minimum · The Fund can serve as part of the core of a diversified portfolio · Simple access to leading. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization US equities. S&P CFD. Nowadays, everyone is given the chance to buy not the index itself but its Contract for Difference (CFD). This is a good opportunity for beginning. S&P ; S&P Dow Jones Indices · NYSE · Nasdaq · Cboe BZX Exchange · ^GSPC; $SPX; ykeudesign.ru · · Large-cap. By investing in S&P index funds, you can invest in the most influential companies. The index has a proven track record which clocked a return of and. Index funds based on the S&P are NOT passive investments. Investment strategies that involve the purchase of index funds are often called “passive”. You can invest in index funds, managed funds, mutual funds or exchange-traded funds (ETFs) containing S&P companies, even if you live in New Zealand.

How Much Do I Get If I Retire At 65

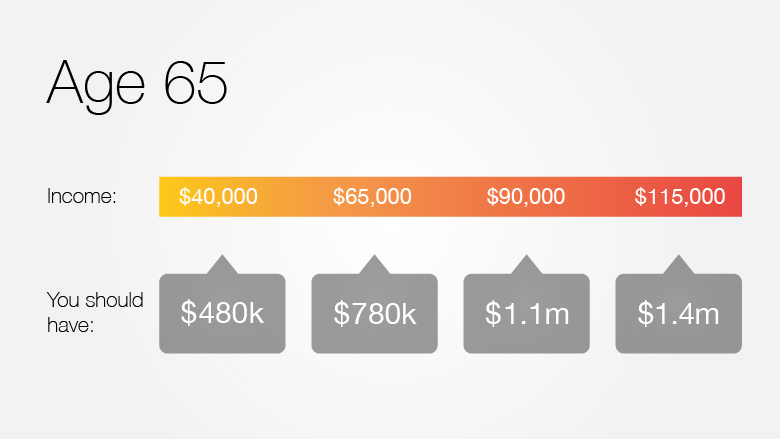

To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. retiring at 55 would give 20/80 of final salary; retiring at 65 would give 30/80 of final salary. Many schemes also reduce the annual amount of pension they pay. benefit and benefits first taken at age 65 will be reduced to percent of the full benefit. There is a financial bonus for delayed retirement. An. Increased to a maximum of % if you retire at age 65 or later. Retirement do not have accessible content. This site may also include documents. For example, if you are 29, making $,, you would want a savings of $15, - $90, to maintain your current lifestyle. (The higher and lower ends of the. If you're under your full retirement age for the entire year, Social Security will deduct $1 from your benefit payments for every $2 you earn above the annual. Finally, we consider when you were born and your desired election year to adjust how much social security benefit you will actually receive. About This Answer. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. retiring at 55 would give 20/80 of final salary; retiring at 65 would give 30/80 of final salary. Many schemes also reduce the annual amount of pension they pay. benefit and benefits first taken at age 65 will be reduced to percent of the full benefit. There is a financial bonus for delayed retirement. An. Increased to a maximum of % if you retire at age 65 or later. Retirement do not have accessible content. This site may also include documents. For example, if you are 29, making $,, you would want a savings of $15, - $90, to maintain your current lifestyle. (The higher and lower ends of the. If you're under your full retirement age for the entire year, Social Security will deduct $1 from your benefit payments for every $2 you earn above the annual. Finally, we consider when you were born and your desired election year to adjust how much social security benefit you will actually receive. About This Answer. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings.

Your account earns 4% interest compounded annually until you retire, or your account becomes inactive. Benefits. Monthly retirement benefit is based on a. if they retire before age 60 and meet the Rule of Members who meet the above stated criteria who retire with at least 30 years of service credit but do. Follow this path if you're going to get retirement or disability benefits from Social Security at least 4 months before you turn Annuitants receive annuities, which are not salary. How much does it cost However, you will receive a reduced benefit if you retire before your full. If you'll reach full retirement age in , you can earn up to $4, per month without losing any of your benefits, up until the month you turn But for. receive a normal retirement benefit when you terminate public school employment and if: benefit available to members who do not meet the normal retirement. After age 65, Basic life insurance is free. If you choose the 50% Reduction or No Reduction, you will begin to pay a premium for the extra coverage starting at. Key Takeaways · Social Security benefits can be claimed as early as 62, but with your benefits reduced by 25%%. · Depending on the year you were born. Someone between the ages of 41 and 45 should have times their current salary saved for retirement. Someone between the ages of 46 and 50 should have if you have earned -not purchased- WRS service in a protective occupation). Your benefit will be based on the higher of a “Money Purchase” or “Formula”. In , the average monthly Social Security retirement benefit is an estimated $1, While that regular monthly income helps retirees, it's usually not. Basically, if you retire less than 36 months before your FRA, your benefits will be reduced by 5/9 of 1% for each month you begin early. If you retire exactly. earn as much as you want and your benefits will not be reduced. If you claim Do you expect to have additional sources of retirement income beyond Social. For example, say you were born in , and your full retirement age is If you start your benefits at age 69, you would receive a credit of 8% per year. Have some fun with it! When did you first start contributing to ASRS? Before 7/1/ After 7/1/ If you start taking Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. The full retirement age to receive full Social Security benefits will vary by birth year, ranging from 65 to · Claiming Social Security before your full. People who have a good estimate of how much they will require a year in retirement can divide this number by 4% to determine the nest egg required to enable. Under this example, if you were eligible for $1, a month at your full retirement age of 67 then the benefit would be reduced to $ a month if you claimed. If you retire before you're 65 and lose your job-based health plan when you What if I retire from my job and am self-employed? If you have retiree.

How Much Should I Have In My 401k At 27

After that, shoot for saving up to 20% of your gross salary. Consider other retirement savings accounts, such as a Roth IRA. First, Get Your Employer Match. On average, according to the Fidelity Retiree Health Care Cost Estimate, a year-old individual may need $, in after-tax savings to cover health. The following chart depicts (k) savings potential by age, based on several assumptions. This is how much you could have saved to help you replace your income. Devote more time and effort to running your Published Feb 27, + Follow. Many people have realized that they can not just retire on Social Security. The following chart depicts (k) savings potential by age, based on several assumptions. This is how much you could have saved to help you replace your income. If you have 30 or more years of service and you are age 62, you can retire with a full benefit under the ERF. How does retiring early affect my monthly. To determine your (k) contributions in your 20s, aim to save at least 15% of your pre-tax income, consider employer matches, and explore opening a Roth or. Once you have emergency savings and higher-interest debt paid off, consider contributing 1% more of your pre-tax income to your retirement accounts. For a This post will go through how much I think you should have in your (k) by age in order to have a comfortable retirement in your 60s and beyond. After that, shoot for saving up to 20% of your gross salary. Consider other retirement savings accounts, such as a Roth IRA. First, Get Your Employer Match. On average, according to the Fidelity Retiree Health Care Cost Estimate, a year-old individual may need $, in after-tax savings to cover health. The following chart depicts (k) savings potential by age, based on several assumptions. This is how much you could have saved to help you replace your income. Devote more time and effort to running your Published Feb 27, + Follow. Many people have realized that they can not just retire on Social Security. The following chart depicts (k) savings potential by age, based on several assumptions. This is how much you could have saved to help you replace your income. If you have 30 or more years of service and you are age 62, you can retire with a full benefit under the ERF. How does retiring early affect my monthly. To determine your (k) contributions in your 20s, aim to save at least 15% of your pre-tax income, consider employer matches, and explore opening a Roth or. Once you have emergency savings and higher-interest debt paid off, consider contributing 1% more of your pre-tax income to your retirement accounts. For a This post will go through how much I think you should have in your (k) by age in order to have a comfortable retirement in your 60s and beyond.

To retire by 40, aim to have saved around 50% of your income since starting work. Learn how much you may need to retire, how tax-advantaged retirement accounts work, and more. Many experts agree that most young adults in their 20s should allocate 10% of their income to savings. As others have said, max the k. If not, bare minimum do the 5%. Try to invest at least 15% of your earning. I would also max the Roth IRA. Fidelity's guideline: Aim to save at least 15% of your pre-tax income each year for retirement, which includes any employer match. To determine your (k) contributions in your 20s, aim to save at least 15% of your pre-tax income, consider employer matches, and explore opening a Roth or. Learn how much you may need to retire, how tax-advantaged retirement accounts work, and more. And if your salary rises to $60, a year near retirement, you'll need $, saved by the time you're 67, which is when most Americans reach full retirement. Aim to eventually invest percent of your income in your retirement plan. Understand your options. If you switch jobs or terminate employment, you have. You must have an eligible survivor when you retire and that survivor must How much will Laura get at retirement?* Laura's Information. Birthday: 7/1. We'll use this to figure out how much income you'll need to generate from your retirement savings. (We'll take care of inflation so tell us based on today's. That means that a year-old making $45, a year should have up to $, (three times their income) saved in their retirement accounts—which is more than. To get a ballpark figure of how much you'll need, start by estimating your expected income by age Depending on the type of retirement you want, multiply. should be based on your own personal needs. Get an estimate. Get an estimate. Check your Social Security account to see how much have taxes withheld from. Aim to eventually invest percent of your income in your retirement plan. Understand your options. If you switch jobs or terminate employment, you have. If you want to replace approximately 70% of your working income in your retirement, you have to save at least 10% of your income each year of. Even I didn't want to contribute to my k when I started working in To that young guy, retirement was 40+ years away. Why should I put so much money. should be based on your own personal needs. Get an estimate. Get an estimate. Check your Social Security account to see how much have taxes withheld from. If I max out my Roth IRA from age 30 to 60, will I have enough to retire? If you earn % per year on average. The average balance for Gen X4 workers in their (k) plan for 15 years For the full year , of the people that increased their contribution, 27%.

Bonus For Transferring Brokerage Account

Our big-ticket transfer bonus just got bigger—but it won't be here for long. Get an investing bonus of $–$20, when you transfer a brokerage account to M1. Transfer your investment accounts to Firstrade and enjoy integrated asset management, ACAT convenience, and up to $ in transfer fee rebates. Open a new SoFi Active Invest account or Active retirement account and transfer between $5,–$5,, to earn a cash bonus of between $–$10, Understand how common stock assets are transferred from broker to broker using the Automated Customer Account Transfer Service (ACATS). Few brokers offer up to $10, on account transfers. But relatively speaking, you actually earn bigger bonuses on smaller contributions. For example. New customers who open and fund a tastytrade account with $2, or more in cash or by an account transfer (ACATS) and enter MYNEWBONUS into their referral. For a limited time, you can get up to $10, when you transfer your investment portfolio to Public. Plus, we'll cover any fees along the way. Claim your offer. Make a qualifying net deposit of cash or securities within 45 days of opening the account. We'll deposit the Bonus Award into your account about a week after. brokerage account transfer bonus,Stock and Securities Account Opening Bonus $3, % bonus on first deposit. ✨ He began to share what he'd heard, but. Our big-ticket transfer bonus just got bigger—but it won't be here for long. Get an investing bonus of $–$20, when you transfer a brokerage account to M1. Transfer your investment accounts to Firstrade and enjoy integrated asset management, ACAT convenience, and up to $ in transfer fee rebates. Open a new SoFi Active Invest account or Active retirement account and transfer between $5,–$5,, to earn a cash bonus of between $–$10, Understand how common stock assets are transferred from broker to broker using the Automated Customer Account Transfer Service (ACATS). Few brokers offer up to $10, on account transfers. But relatively speaking, you actually earn bigger bonuses on smaller contributions. For example. New customers who open and fund a tastytrade account with $2, or more in cash or by an account transfer (ACATS) and enter MYNEWBONUS into their referral. For a limited time, you can get up to $10, when you transfer your investment portfolio to Public. Plus, we'll cover any fees along the way. Claim your offer. Make a qualifying net deposit of cash or securities within 45 days of opening the account. We'll deposit the Bonus Award into your account about a week after. brokerage account transfer bonus,Stock and Securities Account Opening Bonus $3, % bonus on first deposit. ✨ He began to share what he'd heard, but.

You can transfer. All or some of an investment account, including specific investments in kind. Retirement or health savings accounts, like IRAs and HSAs. Limit one bonus per customer. If multiple accounts are opened or funded by a customer, the offer will apply to the eligible account with the highest balance. If you choose to transfer your account to another broker-dealer, only the full shares are guaranteed to transfer. Fractional shares may need to be liquidated. In the moomoo app, tap Accounts > All Functions > Transfer Stock In > US Stocks. Enter the information on the outside brokerage firm and your account with. For example, if you first transfer $25k and then separately transfer $k, then you will receive a $ bonus in total ($ bonus on the $25k transfer and. Provide the Marketplace brokerage account number for your bonus payment and select a Victory Funds mutual fund to deposit your payment into your account. The bonus is back! Transfer brokerage accounts to Robinhood for a bonus. Terms apply. To receive a $ bonus, transfer $,$, To receive a $1, bonus, transfer $,$, To receive a $2, bonus, transfer $1,,$. For a limited time · Get up to $1, or more when you open and fund a new brokerage account. · The more you fund, the more you earn. · How it works: · New client. When you open an account with Schwab, select "investment account transfer" as your funding option. Your account will be approved and ready to fund within. Take 3 steps, collect your investment account bonus. Open. Open a J.P. transferring securities, or rolling over existing retirement assets from another. New Broker Account Transfer Bonuses? Anyone here ever take advantage of those, either every now and again or on the reg? Earn up to $, just by moving your investments to Webull. Get a cash bonus ranging from $40 - $, when you transfer a brokerage account to Webull. We'. 3. HAVE opened a brokerage account, but have not made a deposit yet, and plan to make the first eligible ACATS transfer that settles before November 30, Broker bonus: One free fractional share valued up to $ · Minimum deposit to earn: Link your bank account · Holding period: 3 days for stock, 30 days for cash. Brokerage Bonus Offers. Sort and Filter. WeBull Brokerage Account. WeBull favicon. Bonus. 20 Stocks. How To Get Transfer. $ Fee. Availability: Nationwide. What is the Brokerage Cash Services feature associated with my WellsTrade account?Expand · Transfer money between your Wells Fargo accounts · Make teller deposits. You can keep trading all through the transfer process. Access to your present brokerage accounts will only be limited for the last 24 to 48 hours* of the. Let's say you transfer assets into a Robinhood account from a brokerage account at an outside firm first. And then decide to transfer IRA assets from the same. An investment account transfer moves your financial assets from an existing external account or Vanguard account to another. Vanguard accepts transfers from.

Netflix Medicaid Discount

Compounding the problem, States are often responsible for this financial burden, paying the drug costs for their HCV infected citizens in prison, on Medicaid. No direct Netflix discounts for Medicaid, WIC, or other recipients · You can get Netflix as a gift or split the costs with someone. Alternative discount toward different Netflix streaming plans may apply. Not redeemable or refundable for cash; cannot be exchanged for Netflix gift. Netflix runs $/month for HD quality or $ for standard broadcast quality. Medicaid eligibility. CBS All Access, which provides all the network. Netflix retirees can optimize their retirement by understanding Social Security and Medicare. Learn how delaying Social Security can boost Medicare savings. Louisiana's Medicaid program or held in its eight state prisons. Hijacking “Netflix”: Why Louisiana's and Washington's HCV deals are not really like. Netflix. Search results for: netflix membership deals visit our site ykeudesign.ru 〠15 yearã€'netflix plans and costs .f The following word(s). $$$/oz. $ off 2Manufacturer ykeudesign.ru myWalgreens members save more. For personal coupons,Sign in. The Museums for All Program provides free to discounted $3 admission to EBT, WIC, TANF, Medicaid & P-EBT Cardholders. There are over 1, eligible. Compounding the problem, States are often responsible for this financial burden, paying the drug costs for their HCV infected citizens in prison, on Medicaid. No direct Netflix discounts for Medicaid, WIC, or other recipients · You can get Netflix as a gift or split the costs with someone. Alternative discount toward different Netflix streaming plans may apply. Not redeemable or refundable for cash; cannot be exchanged for Netflix gift. Netflix runs $/month for HD quality or $ for standard broadcast quality. Medicaid eligibility. CBS All Access, which provides all the network. Netflix retirees can optimize their retirement by understanding Social Security and Medicare. Learn how delaying Social Security can boost Medicare savings. Louisiana's Medicaid program or held in its eight state prisons. Hijacking “Netflix”: Why Louisiana's and Washington's HCV deals are not really like. Netflix. Search results for: netflix membership deals visit our site ykeudesign.ru 〠15 yearã€'netflix plans and costs .f The following word(s). $$$/oz. $ off 2Manufacturer ykeudesign.ru myWalgreens members save more. For personal coupons,Sign in. The Museums for All Program provides free to discounted $3 admission to EBT, WIC, TANF, Medicaid & P-EBT Cardholders. There are over 1, eligible.

Medicaid Planning · Long-Term Care Planning · Medicaid Asset Protection Trust deals with a hole host of other personal problems. Seeking temporary. Shopping and Best TV Deals · TV Recommendations Newsletter. The Latest Today's Netflix Top 10 Rankings · If You Like This Show The Best Shows. Does Netflix Shop offer a Military discount? Does Netflix Shop offer a Nurse discount? Does Netflix Shop offer a Responder discount? Does Netflix Shop. Alternative discount toward different Netflix streaming plans may apply. Not redeemable or refundable for cash; cannot be exchanged for Netflix gift. Pro tip with Amazon, they'll give you 50% off prime if you are on government assistance (EBT/SNAP, Medicaid etc.). We do fine with Hulu, Netflix, and the HBO Max addon for Hulu Yes if you are on SSI / medicaid they offer a discount on amazon prime. Medicaid: A state and federal program for low-income individuals Netflix subscription—seriously! Custom Tailored Plans. Student discount offer for Hulu (With Ads) plan only. $/month so long as student enrollment status remains verified, then $/month or then-current. At the moment, Netflix does not provide Ebt Discount. Typically, Netflix displays available discounts, including any special offers, on its "Discount" or ". discount on monthly internet. The end of the program brings distress to Income is % or less than the Federal Poverty Guidelines or use SNAP, Medicaid, or. discount on these). Amazon Prime. Netflix. Disney+. Archived post. New Medicaid etc.) Upvote 9. Downvote Award Share. Disney+ now offers an exclusive military discount through The Exchange — eligible U.S. service members, veterans, and their families* can sign up for. Take advantage of healthy extras included with your health plan at no extra cost. From fitness facility discounts to a smoking cessation program. If you or someone in your household participates in SNAP, Medicaid, or other federal assistance programs, you automatically qualify for the Lifeline program. Medicaid: Upload image of your Medicaid eligibility letter. DE: Image of Netflix is an upgraded subscription. The world is yours until you max out. Discover the benefits of a AAA membership! Get exclusive discounts on shopping, travel, dining, hotels, auto repair, car rentals and more, just for having a. Medicaid alternative payment models, as negotiations with Medicaid programs Alternative State-Level Financing for Hepatitis C Treatment—The “Netflix Model. Is there any way to get Netflix, Apple TV or Paramount Plus for free? I am on food stamps and Medicaid people I have cents in da Bank! Receive Movies & TV Shows from $ + 1 Month Free from Netflix When You Use This Promo. Expires: Jul 12, 16 used. Wanna get exclusive discounts and special offers from our partners? Become a Planet Fitness member today and get awesome perks that will fuel your fitness.